Thanks to our EBPII expert Gareth Locksley for aggregating and submitting this response to DG COMP

State Aid and Broadband GL Submission Click on Link to read full submission

Specific Comments on DG COMP Questionnaire

The following partial responses draw on the general comments above.

Question 1.3 The development of the ‘free’ business model and the ‘utility’ model should be considered within the Guidelines.

Question 2.2 The Guidelines should consider the possibility of the application of the utility model to these long lasting and long technology life cycle components of B+NGAB. The resultant lowering of prices would clearly serve the objectives of the Commission and the EU regarding affordable and widespread generalised access to B+NGAB.

Question 3.3 The plans should be backed by significant performance guarantee bonds payable to the local authorities when the plans are unfulfilled.

Question 4.1 Competition in B+NGAB being limited to geographically limited areas [for example two thirds of the UK population live in around 10% of the land mass] does to function in a manner similar to ‘traditional’ markets. There are no incentives to address the entire market. New entrants only need to undercut incumbents in the most attractive markets. Far greater incentives or more active public intervention is required outside these limited areas.

Question 5.1 There are always difficulties with incumbents and the difficulties rise with the degree and intensity of vertical integration of incumbents.

Question 5.2 Access to all technological possibilities is required

Question 5.3 At least 7 years. More realistically an obligation for the entire technology life cycle of the component of B+NGAB.

Question 5.4 Multiple fibre infrastructures are highly unlikely to materialise in white areas and are improbable in grey areas without state aid. Effective open access to fibre priced on the utility [or even free model] will provide for competition in the provision of service, applications and content.

Question 5.6 A requirement that the recipient applies a utility [or free] business and pricing model to network infrastructure.

Question 6.1 NRAs could assist authorities in ensuring the business and pricing model of the response to 5.6.

Question 8.1 Separation would ease the application of a utility [or free] business and pricing model to network infrastructure. It would also provide opportunities for investors seeking such risks, returns and appropriate asset backing.

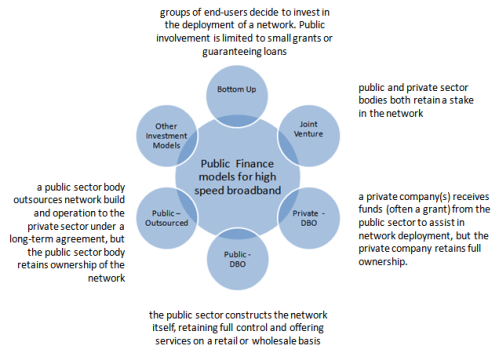

Question 8.2 Public ownership and social enterprises using utility or free models should be allowed for in the Guidelines in white areas where there is a clear market failure. There is also a case for similar arrangements in grey areas, in particular where the incumbent does not transparently price the network infrastructure component of B+NGAB according to its technology life cycle.

Specific comment on existing Guidelines

Art 51 (g) This exercise does not take into account the technology life cycle of the network infrastructure component of B+NGAB, obliging bidders to replicate the business models of incumbents rather than applying valid alternative models.

Broadband-Europe RSS

Broadband-Europe RSS